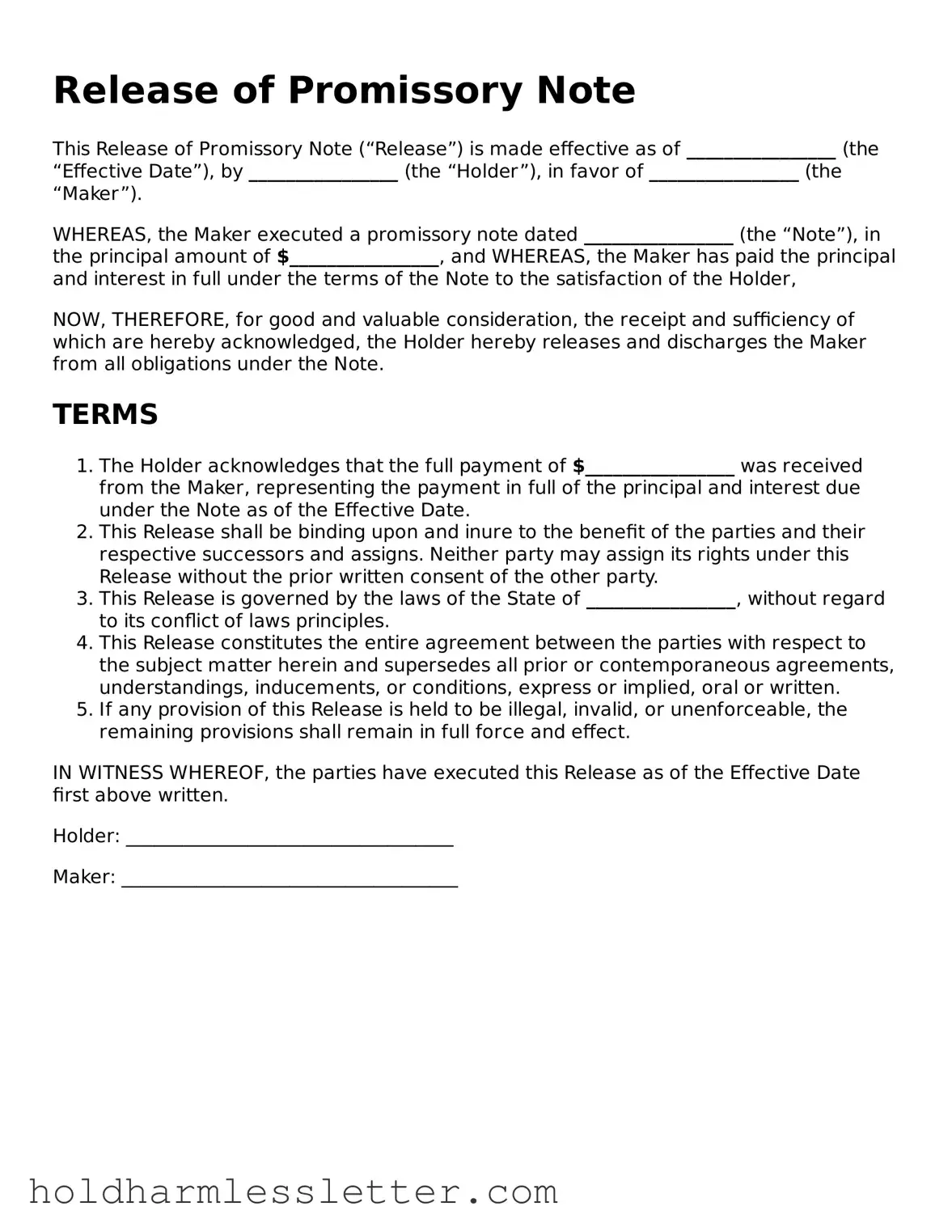

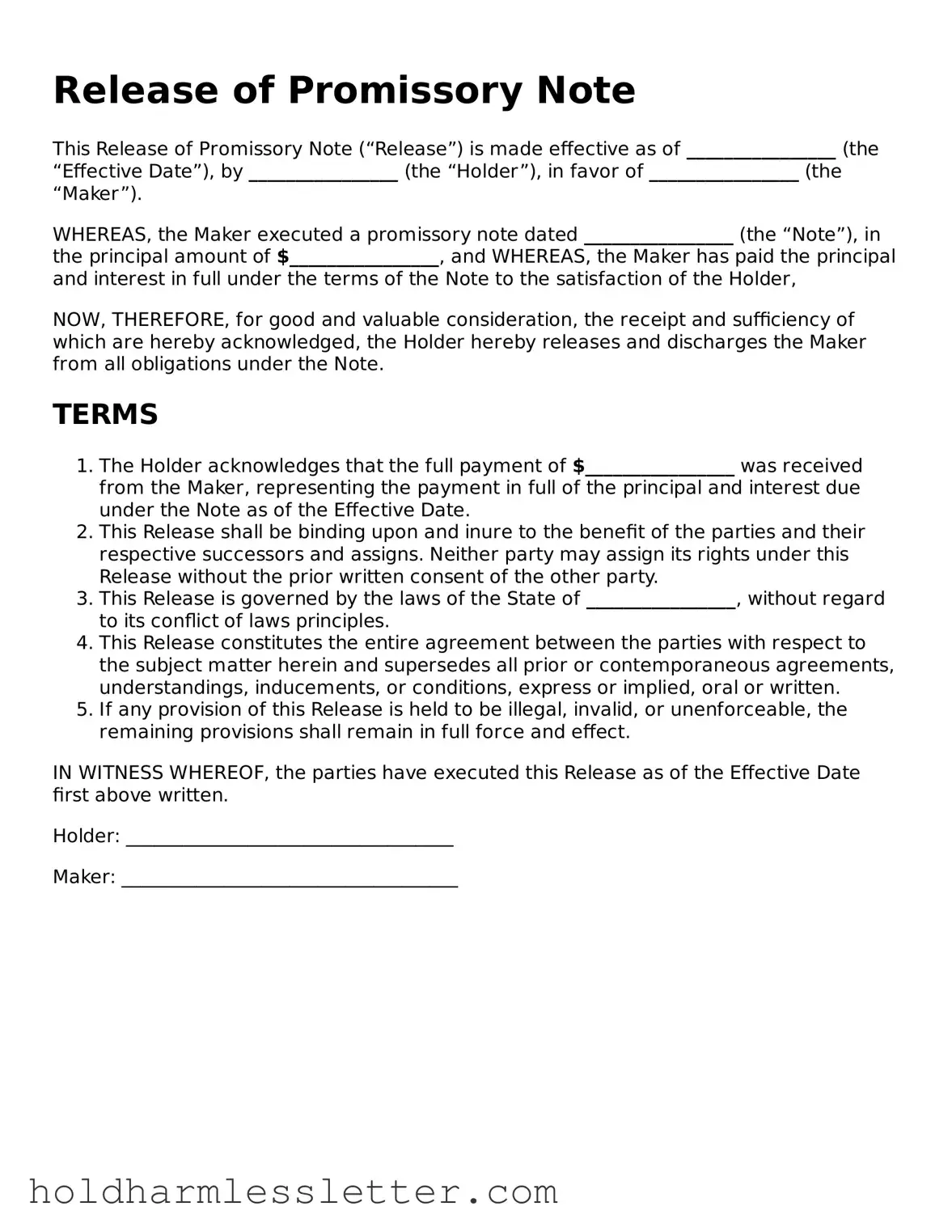

Fillable Release of Promissory Note Template

A Release of Promissory Note form is a legal document that signifies the completion of a loan by indicating that the borrower has fulfilled their payment obligations to the lender. It serves as a release or discharge from any future liability under the promissory note, ensuring that the debt is officially settled. This document is critical in providing peace of mind to all parties involved, confirming the successful closure of a financial agreement.

Access Release of Promissory Note Editor Now

Fillable Release of Promissory Note Template

Access Release of Promissory Note Editor Now

Access Release of Promissory Note Editor Now

or

⇩ Release of Promissory Note File

Your unfinished form is right here

Fill out Release of Promissory Note digitally in minutes — forget printing and scanning.