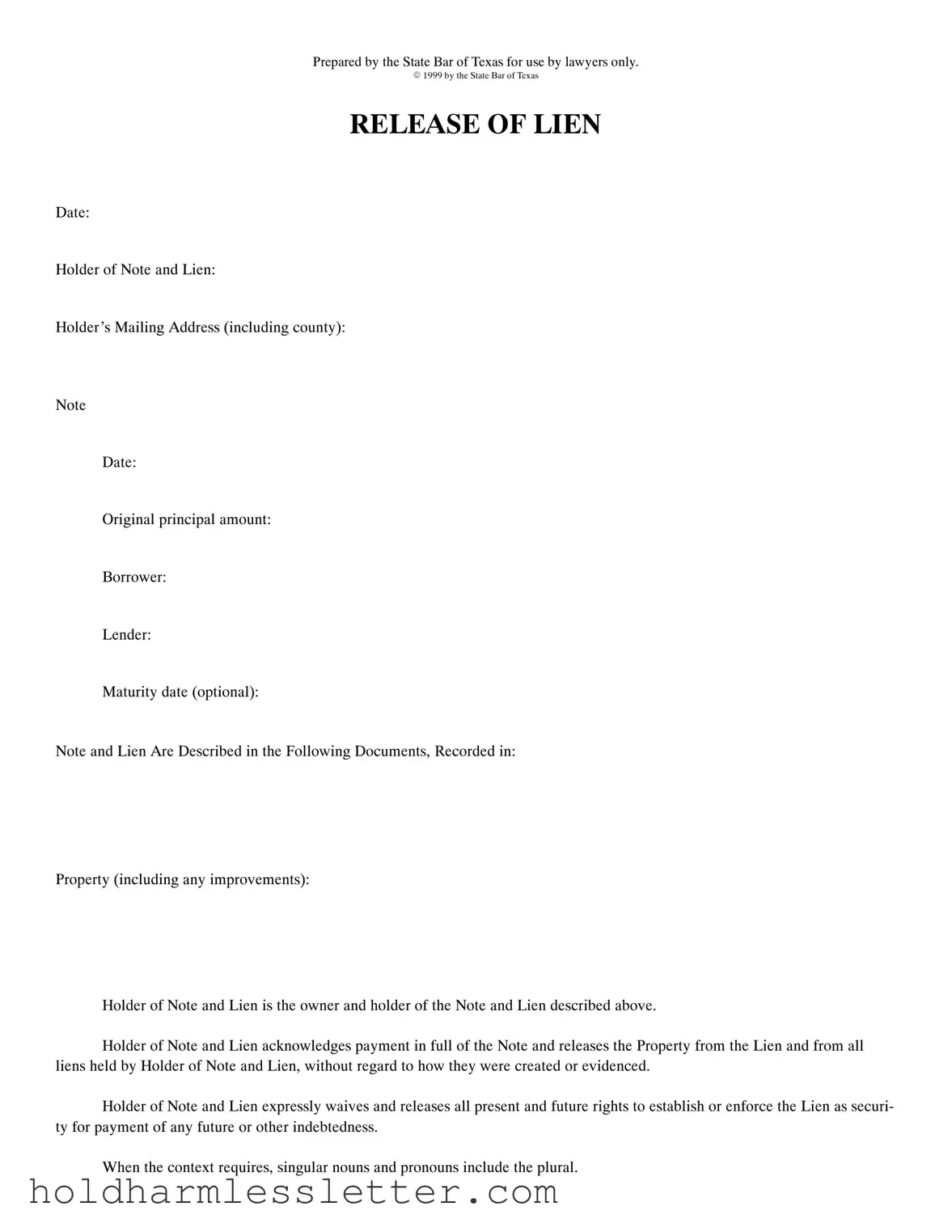

Blank Release Of Lien Texas PDF Template

The Release of Lien Texas form is a legal document designed to discharge a property from any and all liens once the noted debt has been fully paid. Drafted by the State Bar of Texas specifically for lawyer use, this form articulates the settlement between the lienholder and the party responsible for the debt, effectively removing the lienholder's claim to the property. Through its execution, the holder of the note and lien acknowledges the payment in full and relinquishes any rights to enforce the lien against the property in the future.

Access Release Of Lien Texas Editor Now

Blank Release Of Lien Texas PDF Template

Access Release Of Lien Texas Editor Now

Access Release Of Lien Texas Editor Now

or

⇩ Release Of Lien Texas File

Your unfinished form is right here

Fill out Release Of Lien Texas digitally in minutes — forget printing and scanning.