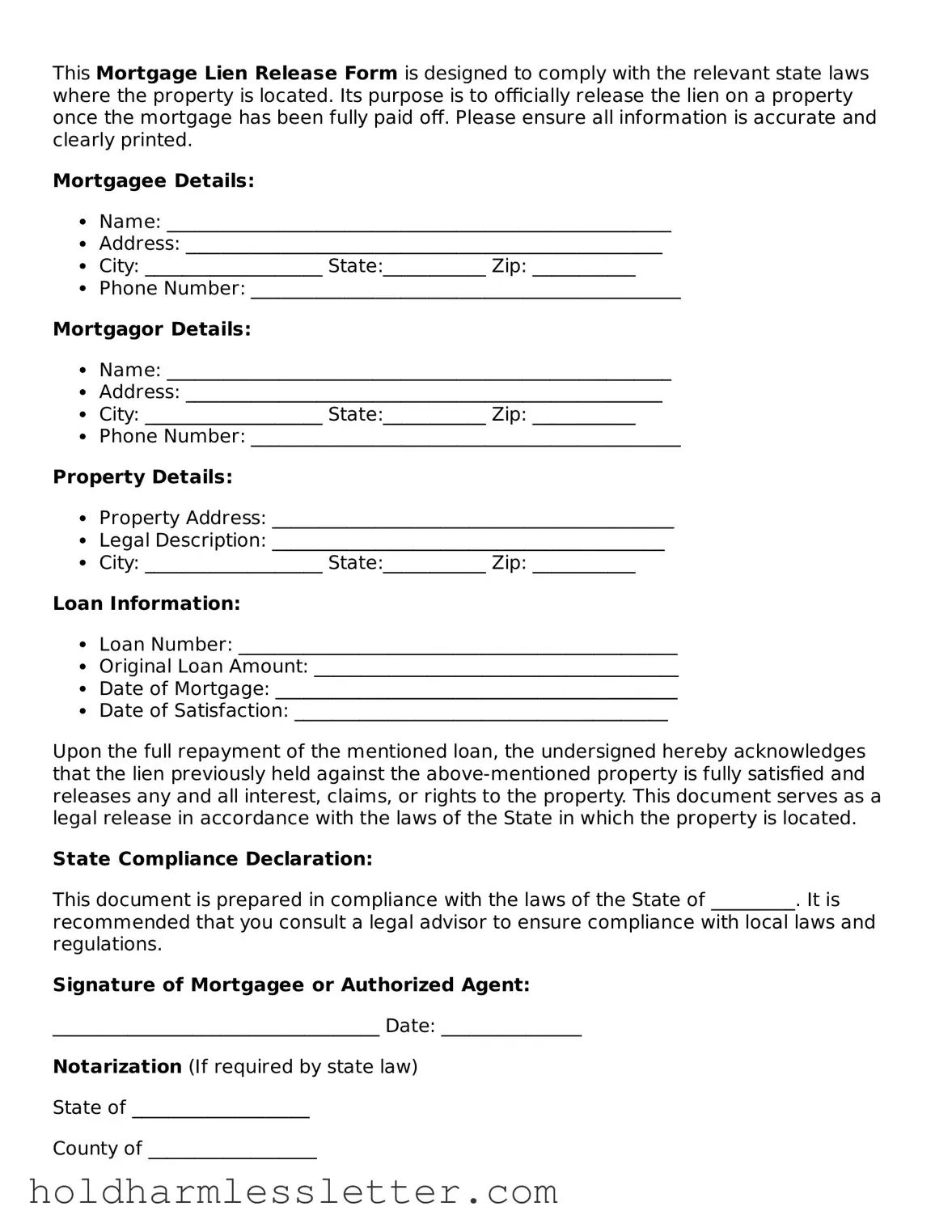

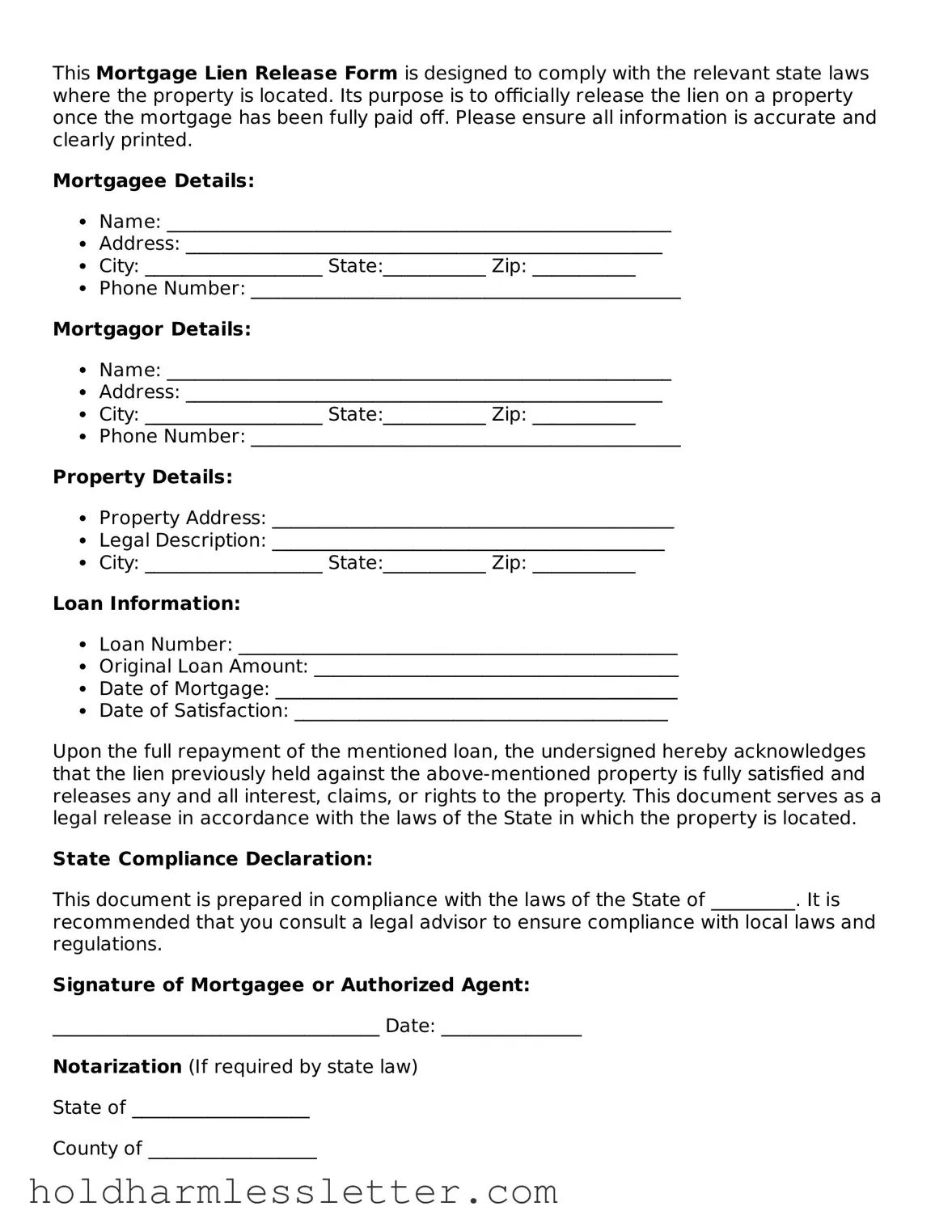

Fillable Mortgage Lien Release Template

A Mortgage Lien Release form serves as a legal document, evidencing the full repayment of a mortgage loan, thereby removing the lender's legal claim or "lien" on the property. This form is vital for homeowners, marking the culmination of their mortgage journey and restoring their full ownership rights. Its proper filing ensures that public records accurately reflect the property's clear title, free from the encumbrance of the prior mortgage.

Access Mortgage Lien Release Editor Now

Fillable Mortgage Lien Release Template

Access Mortgage Lien Release Editor Now

Access Mortgage Lien Release Editor Now

or

⇩ Mortgage Lien Release File

Your unfinished form is right here

Fill out Mortgage Lien Release digitally in minutes — forget printing and scanning.