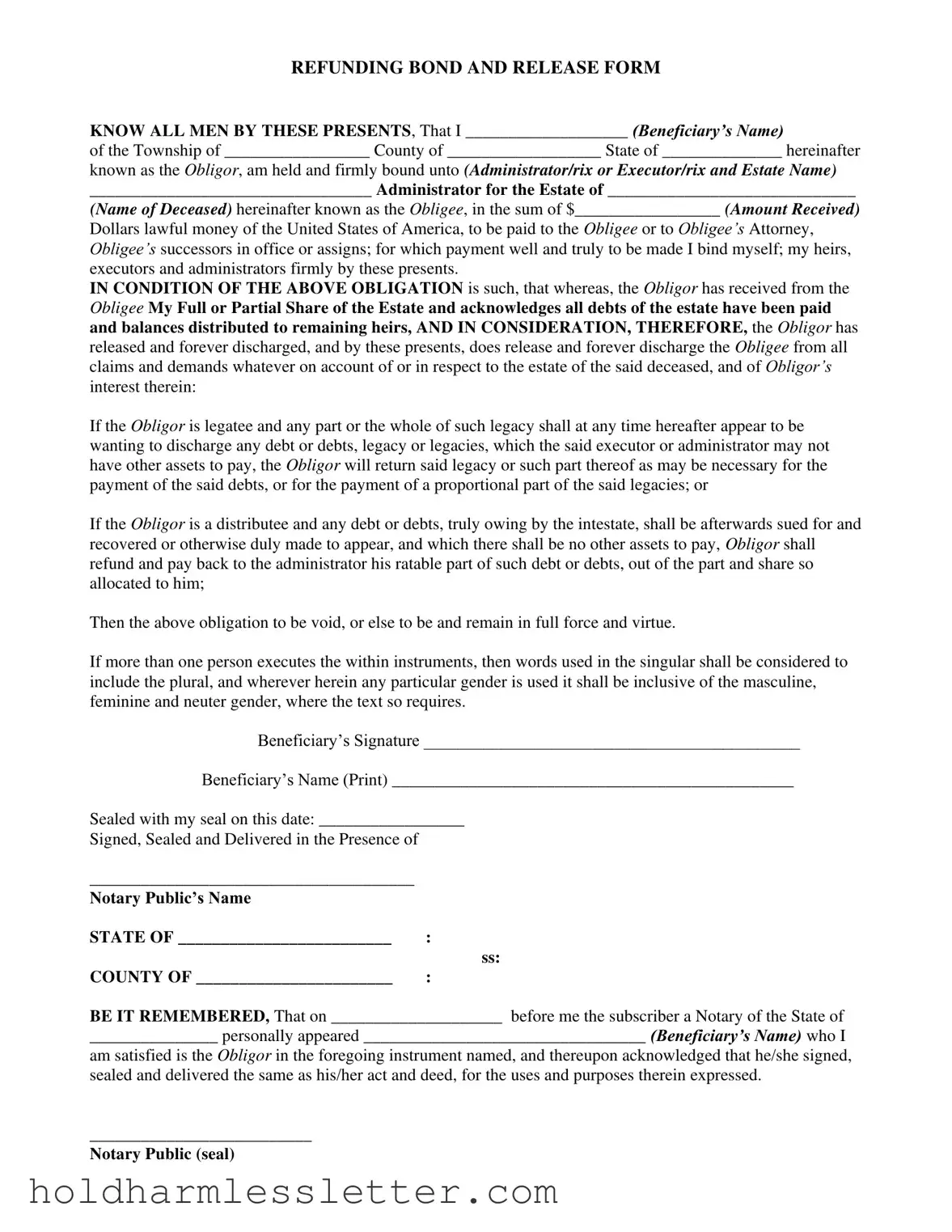

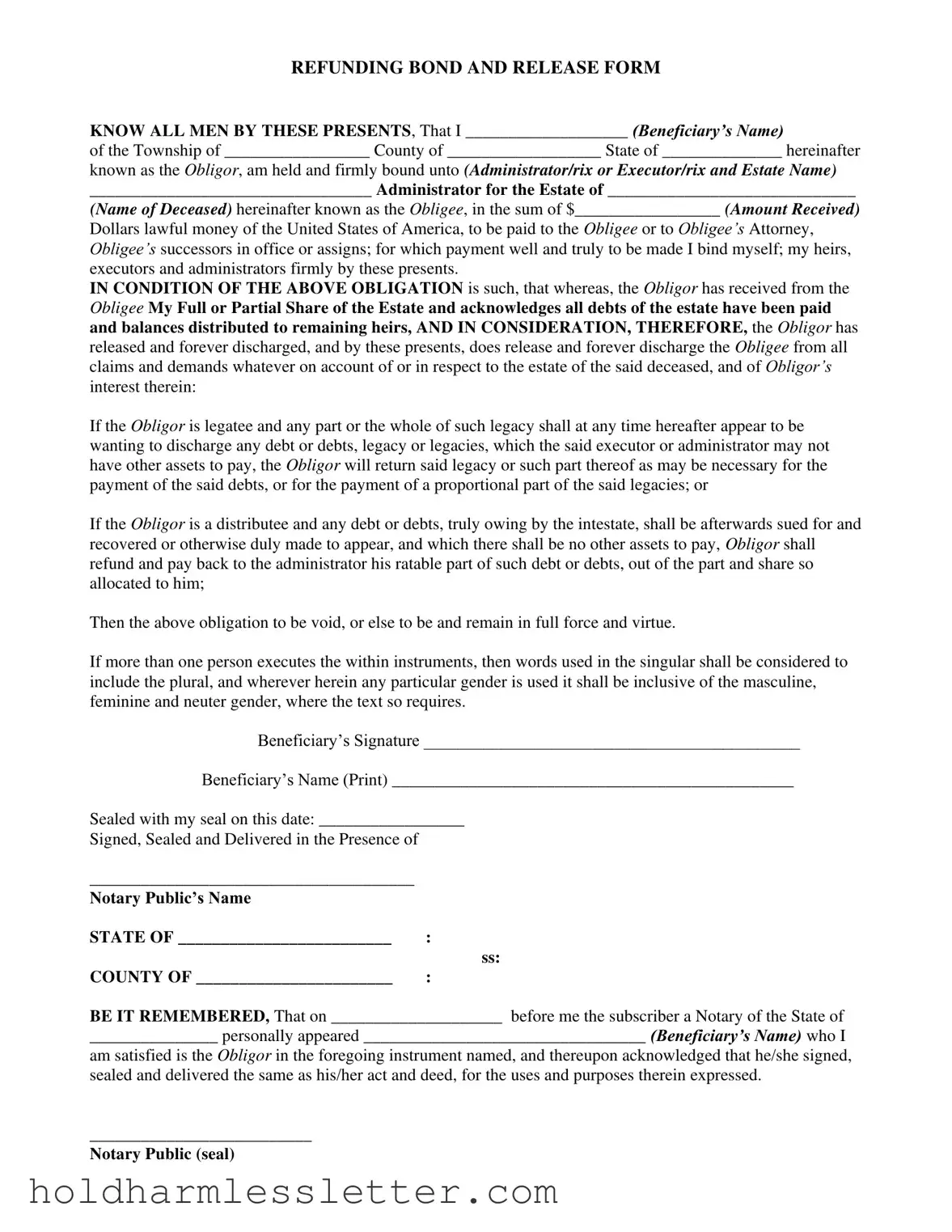

REFUNDING BOND AND RELEASE FORM

KNOW ALL MEN BY THESE PRESENTS, That I ___________________ (Beneficiary’s Name)

of the Township of _________________ County of __________________ State of ______________ hereinafter

known as the Obligor, am held and firmly bound unto (ADMINISTRATOR/RIX OR EXECUTOR/RIX AND ESTATE NAME)

_________________________________ Administrator for the Estate of _____________________________

(NAME OF DECEASED) hereinafter known as the Obligee, in the sum of $_________________ (AMOUNT RECEIVED)

Dollars lawful money of the United States of America, to be paid to the Obligee or to Obligee’s Attorney, Obligee’s successors in office or assigns; for which payment well and truly to be made I bind myself; my heirs,

executors and administrators firmly by these presents.

IN CONDITION OF THE ABOVE OBLIGATION is such, that whereas, the Obligor has received from the Obligee My Full or Partial Share of the Estate and acknowledges all debts of the estate have been paid and balances distributed to remaining heirs, AND IN CONSIDERATION, THEREFORE, the Obligor has

released and forever discharged, and by these presents, does release and forever discharge the Obligee from all claims and demands whatever on account of or in respect to the estate of the said deceased, and of Obligor’s

interest therein:

If the Obligor is legatee and any part or the whole of such legacy shall at any time hereafter appear to be wanting to discharge any debt or debts, legacy or legacies, which the said executor or administrator may not have other assets to pay, the Obligor will return said legacy or such part thereof as may be necessary for the payment of the said debts, or for the payment of a proportional part of the said legacies; or

If the Obligor is a distributee and any debt or debts, truly owing by the intestate, shall be afterwards sued for and recovered or otherwise duly made to appear, and which there shall be no other assets to pay, Obligor shall refund and pay back to the administrator his ratable part of such debt or debts, out of the part and share so allocated to him;

Then the above obligation to be void, or else to be and remain in full force and virtue.

If more than one person executes the within instruments, then words used in the singular shall be considered to include the plural, and wherever herein any particular gender is used it shall be inclusive of the masculine, feminine and neuter gender, where the text so requires.

Beneficiary’s Signature ____________________________________________

Beneficiary’s Name (Print) _______________________________________________

Sealed with my seal on this date: _________________

Signed, Sealed and Delivered in the Presence of

______________________________________

Notary Public’s Name

STATE OF _________________________ |

: |

|

ss: |

COUNTY OF _______________________ |

: |

BE IT REMEMBERED, That on ____________________ before me the subscriber a Notary of the State of

_______________ personally appeared _________________________________ (Beneficiary’s Name) who I

am satisfied is the Obligor in the foregoing instrument named, and thereupon acknowledged that he/she signed, sealed and delivered the same as his/her act and deed, for the uses and purposes therein expressed.

__________________________

Notary Public (seal)