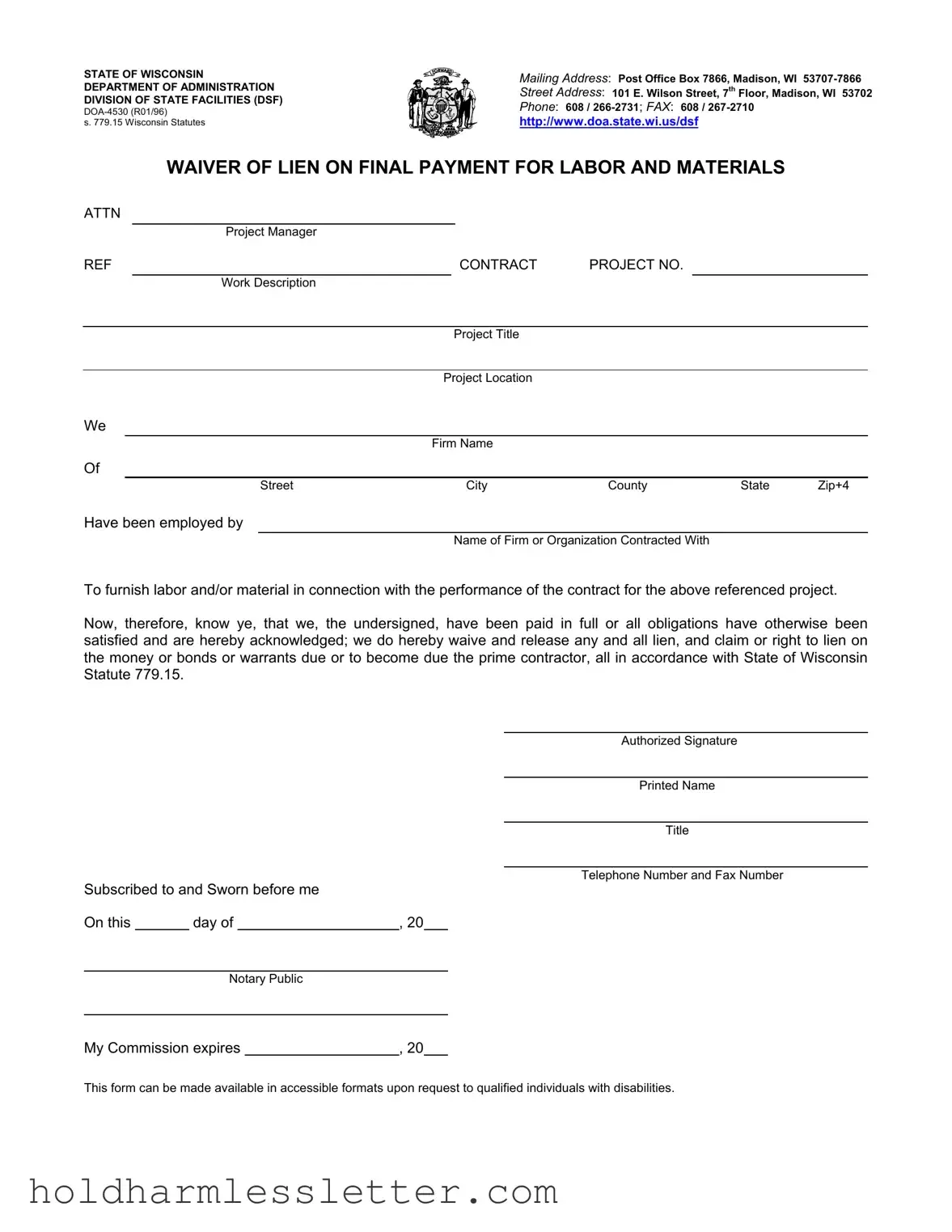

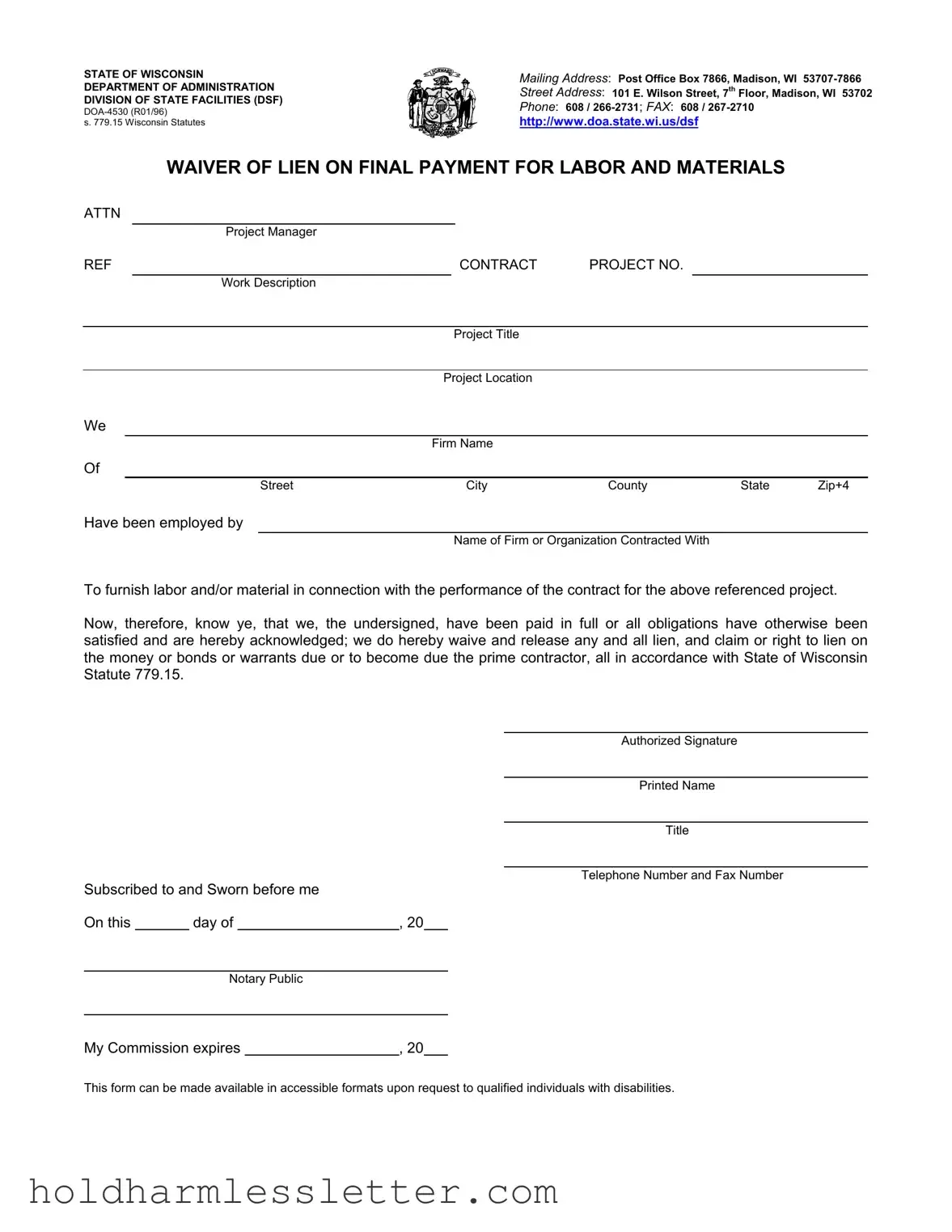

Blank Lien Waiver Wisconsin PDF Template

The Lien Waiver Wisconsin form is a legal document that contractors use to waive their rights to place a lien on a property after receiving payment for labor and materials provided. This form specifically adheres to Section 779.15 of the Wisconsin Statutes and is typically required to ensure a smooth transaction and clear title during the final stages of a construction project. By signing this waiver, contractors affirm that they have been fully compensated and relinquish any future claims against the property related to the project.

Access Lien Waiver Wisconsin Editor Now

Blank Lien Waiver Wisconsin PDF Template

Access Lien Waiver Wisconsin Editor Now

Access Lien Waiver Wisconsin Editor Now

or

⇩ Lien Waiver Wisconsin File

Your unfinished form is right here

Fill out Lien Waiver Wisconsin digitally in minutes — forget printing and scanning.